The Palm Bay Yacht Club stands 27 stories high at 780 NE 69th St., and real estate listings for its residences – with price tags between $338,000-$600,000 – boast of Biscayne Bay views, luxury amenities and an idyllic South Florida lifestyle.

What’s not included in those effusive property descriptions is that current owners are being told they must agree to cough up more than $175,000 each to bring the building up to snuff to pass its 40-year recertification – repairs the condominium association says will cost $46 million.

The Champlain Towers South Condo Association approved a $15 million assessment in April 2021 to complete repairs in preparation for its 40-year recertification process. The oceanfront 12-story building in Surfside collapsed weeks later on June 24, killing 98 people.

And, just as the Champlain Towers residents were shocked to receive assessments ranging from $80,190 to $336,135 for those proposed repairs prior to that tragedy, many owners at Palm Bay Yacht Club are similarly shaken, saying they can’t afford to pay, either.

Fear, anger, disbelief and despair are words condo owner of 13 years, Sonia Przulji, used to describe her initial reaction to the $46 million dollar loan her condo association wants owners to take on. Przulji is an ICU nurse and the sole provider of her household.

“My entire life and livelihood are on the line,” said Przulji. “If we cannot make this assessment then I lose my home.”

Przulji is far from alone in her sentiments. Ten dissenting owners filed a lawsuit in circuit court last October against the association, its board of directors, the property manager and others citing “questionable financial decisions.” Unspecified damages are sought. Among accusations of fraud and negligence, the plaintiffs claim the association wasted funds by focusing on superficial and nonessential upgrades to the building.

“Sometimes, when you have unscrupulous people in leadership roles, there will be problems like election tampering, ill-advised spending or outright theft,’’ said attorney Jane Muir, the Coral Gables lawyer representing the plaintiffs. “Our clients believe that Palm Bay Yacht Club’s leadership, including the board and the management company, have made serious misstatements of fact that rise to the level of fraud in an effort to persuade the association members to borrow $46 million.”

“We are fighting against this unjust assessment that many of our neighbors cannot afford to pay,” said Cristian Murray, a plaintiff and condo owner since 2017. “They will be homeless.”

Sydney Harnett, age 84, has lived in the Palm Bay Yacht Club for 30 years and says she never dreamt of something like this happening.

“I would be forced out of my apartment,” said Harnett. “My home, where I’ve lived for a very long time. There are a few people who live here who have a lot of money, (but) the vast majority work for a living and do not have a lot of money. And if [the defendants] want an empty building, that’s what they’re going to get.”

But the condo association says residents can’t afford to not pay the assessment. Jonathan Goldstein, a lawyer for the association, declined to be interviewed for this story but emailed a statement on behalf of his clients.

“The Association vigorously disputes the lawsuit, which in the Association’s opinion is an attempt to disrupt the Association’s reasonable efforts to protect the building and comply with 40-year recertification requirements,” he wrote. “The safety of all members and compliance with recertification requirements are the Association’s foremost concern and responsibility at this point. In pursuing this project, the Association relies on the professional judgment of its qualified professional experts and project management team.”

What Does $46 Million Cover?

So exactly what would the $46 million loan pay for? It’s hard to say because neither side in the dispute would share an itemized list of needed repairs that add up to that hefty figure.

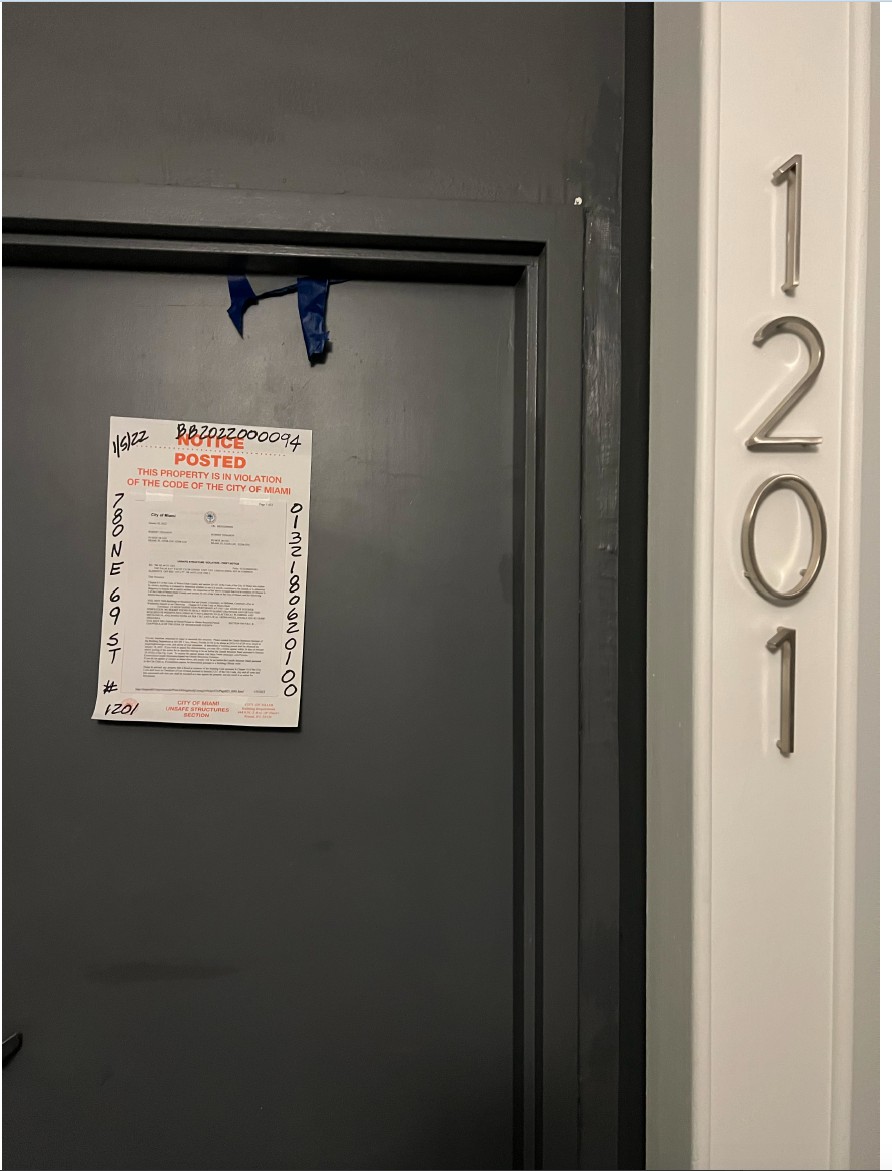

While repeated requests from the Times went unanswered, a copy of the plaintiffs’ complaint filed with the court and plans for proposed remodeling and structural repairs submitted to the city of Miami reveal that extensive prior repairs and enhancements to the Palm Bay Yacht Club were made without permits, resulting in numerous citations for city code violations.

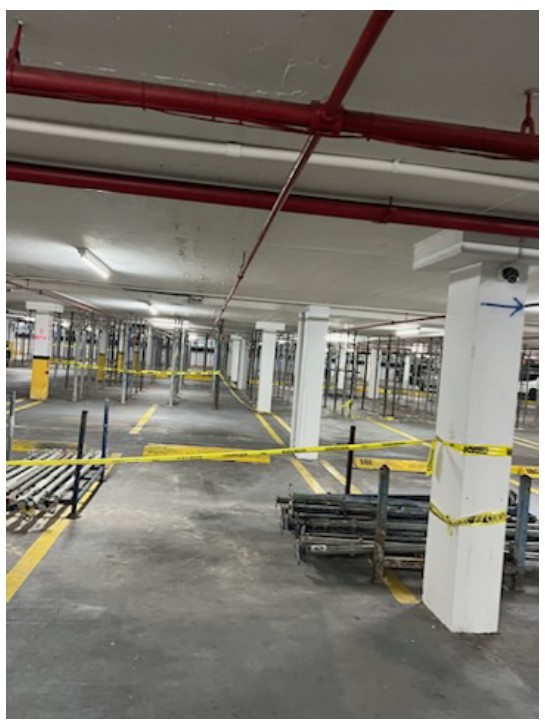

The complaint, filed in Miami-Dade Circuit Court, lists unpermitted electrical, plumbing, HVAC and other construction work throughout the condominium building, including the gym, spa, pool deck, on-site restaurant and other amenities, such as the parking garage. D&R Contracting Corp. is cited in the lawsuit as having performed at least some of the unpermitted work.

Plans submitted to the city show diagrams of all such work that will have to be torn out and completed anew, with proper permitting. Presumably, this is a significant portion of the estimated $46 million.

The plaintiffs also accuse their condo association of misappropriating $4 million from an insurance claim for damages suffered during Hurricane Irma in 2017. Instead, according to the legal complaint, “defendants required unit owners to pay a special assessment to make the repairs and retained the insurance proceeds.”

All the while, dissenting owners and plaintiffs have been stewing.

“They’ve tried very, very hard to sort of force the unit owners into agreeing to this $46 million loan,” said Genie Anderson, a plaintiff and condo owner since 2015. “And how have they done that? They’ve taken away all our amenities, and a year ago, they shut down the pool. They shut down the jacuzzi, they took away our parking downstairs.”

The tennis court and the pool are still prominently featured on MiamiCondoLifestyle.com, but neither is currently open. A visit to the property revealed parked cars on the tennis court and the pool surrounded by a fence.

The plaintiffs are holding out against the loan until the defendants agree to allow another property management team to conduct an assessment, one they trust to be qualified.

Mistrust of Management

In 2020, the board of directors hired a new property management company, AKAM Living Services Inc. According to the lawsuit, that was done “without ratification by the unit owners.” The lawsuit also alleges that neither the company nor Douglas Weinstein, vice president of operations for the company, have a required real estate broker’s license and are therefore unqualified to serve as property managers.

“We know that we need to have an assessment in order to have the recertification,” Murray said. “None of the owners have any problems with that. It is the law. Our problem is that these assessments have been exaggerated.”

Suspicious of the costs they are being asked to pay and of the qualifications of those who completed the association’s assessment, dissenting residents hired Tamara Reyes, a former Miami-Dade police officer, to investigate.

Reyes founded a company called South Florida Property Owners Consulting to look into corruption among real estate and building associations. Her investigation concluded that the original assessment exaggerated the cost of repairs and damages by more than $11 million. The lawsuit blames Epic Forensics & Engineering Inc. for that, saying the company “exaggerated the damage and structural deficiencies of the Association’s property.”

The association also stands accused of inappropriate spending.

“Reyes found over $100,000 in personal expenditures by [the association’s] staff like Amazon, going out to dinner at restaurants in New York and gifts,” said Muir. “There is no explanation for that other than improper spending.”

Even if residents prove they are being overcharged by $11 million, that still leaves them $35 million in the hole, which is more than double what Champlain Towers South residents would have had to pay.

Safety First

To be clear, neither the complaint nor the repair plans allege that the residential structure of Palm Bay Yacht Club is in any danger of collapse. In fact, pages 2 and 3 of the building plans clearly state that: “The building is structurally safe for present occupancy and will remain safe while repairs are being made.”

Nearly a year after the Champlain Towers tragedy, Florida Senate Bill 4-D passed to address safety concerns for condominiums and cooperative buildings. Coastal condominiums and buildings three stories or higher built between 1982 and 1997 must now undergo recertification by the end of 2024 and then every 10 years afterward.

For coastal condominiums that were built after 1998, the recertification must be done once the buildings turn 25, followed by inspections every 10 years. All other buildings must complete recertification 30 years after initial occupancy and every 10 years afterward. Buildings like the Palm Bay Yacht Club, built before 1982 that have begun the recertification process, will continue to follow that schedule.

The new legislation also eliminates the option for association members to waive and/or redirect certain reserve funds set aside for building components deemed critical to structural soundness and safety.

An unintended consequence of the legislation are scenarios like the one at Palm Bay Yacht Club, where there is little to no return in value for significant capital investment on structural soundness and safety. Under those circumstances, owners are likely to sell out to redevelopers.

At least two hearings have been postponed since residents filed their suit. The next scheduled hearing before Miami-District Court Judge Thomas J. Rebull is set for Feb. 13.

In the meantime, residents in this luxury high-rise say they aren’t giving up.

“We are willing to fight this until the end,” said Przulji. “I want to stay at Palm Bay. I have no plans on going anywhere else, I never thought that I would live anywhere else.”

This report was a collaboration between the Biscayne Times and FIU’s South Florida Media Network.